Author: SOFIAWAGLE

The Benefits of Fixed vs. Variable Loan Interest Rates

Choosing the Right Option for Your Financial Goals

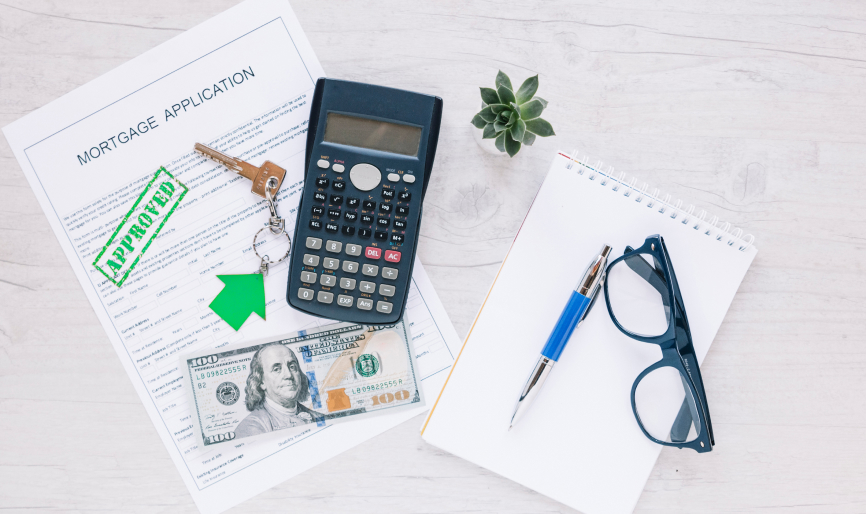

When applying for a mortgage or refinancing an existing loan, one of the most important decisions you’ll face is whether to go with a fixed or variable interest rate. Each option offers its own advantages — and the right choice depends on your goals, financial situation, and appetite for risk.

continue reading5 Common Loan Application Mistakes to Avoid

Protect Your Approval Chances and Borrow Smarter

Applying for a home loan or investment loan is a major financial decision — and small missteps can lead to big delays, rejections, or missed opportunities.

continue readingHow to Improve Your Credit Score Before Applying for a Loan

Simple Steps to Boost Your Chances of Approval

When it comes to applying for a home loan, investment loan, or even a personal loan, your credit score plays a big role in how lenders assess your application. A good credit score can mean lower interest rates, better loan terms, and faster approvals — while a poor score can result in delays or outright rejection.

continue readingA Beginner’s Guide to Securing Your First Loan

Everything You Need to Know Before You Apply

Applying for your first loan — whether it’s for a home, car, or personal goal — can feel overwhelming. With so many lenders, terms, and types of loans available, it’s easy to feel lost in the jargon.

continue readingAchieving Financial Freedom: Kangaroo’s Proven Strategies

Build Wealth, Reduce Debt, and Live Life on Your Terms

Financial freedom isn’t just about having money — it’s about having choices. The choice to live where you want, invest how you want, and support your family without financial stress. At Kangaroo Finance & Mortgage, we believe that the right lending strategy can fast-track your journey to financial independence.

continue reading